Optimize Your Binance Margin Trading Experience: Key Tools You Need to Succeed

Main Takeaways

Familiarizing yourself with margin trading parameters and tools like Average Price, Trade Analysis, Entry Price and Adjusted Entry Price is vital for evaluating trade performance.

Trade Analysis helps track total buy/sell amounts and average prices, providing clarity on your trading performance over a period of time.

Mastering these tools enhances your ability to make informed decisions and improve outcomes in margin trading.

Looking to up your trading game on Binance? In this guide, we will introduce you to the essential trade parameters and intuitive Binance Margin tools designed to help youtrack them that can significantly enhance your experience on our platform.

Understanding Key Trading Parameters

Margin trading can be complex, with many variables contributing to the success of each individual trade. Fortunately, Binance offers a range of tools to help you better assess your trades. Below are the key parameters and some of their relevant features:

Average Price

Average Price represents the mean price of a token observed over a given period of time. Calculated at the pair level for buy and sell orders independently, it allows traders to assess their Profit and Loss (PNL) effectively for the specific pairs they are trading.

The formula for Average Price is simple:

Average Price = Total Position Cost / Position

Position Cost: The purchase cost of the quote token when you are in a long position or the proceeds from selling the quote token in a short position.

Position: The amount of the token you receive from your buy (in a long position) or sell (in a short position).

For example, if you made several BTC/USDC trades over the last 30 days, your Average Buy Price will look like this:

Your Average Buy Price for this period would be:

Average Buy Price = ($62,000 + $63,500 + $61,000) / 3 = $62,166.667

Your Average Sell Price for this period would be:

Average Sell Price = ($64,000 + $62,500) / 2 = $63,250

On Binance Margin, you can calculate this parameter for time periods ranging from 30 to 365 days.

How to access Average Price on Binance?

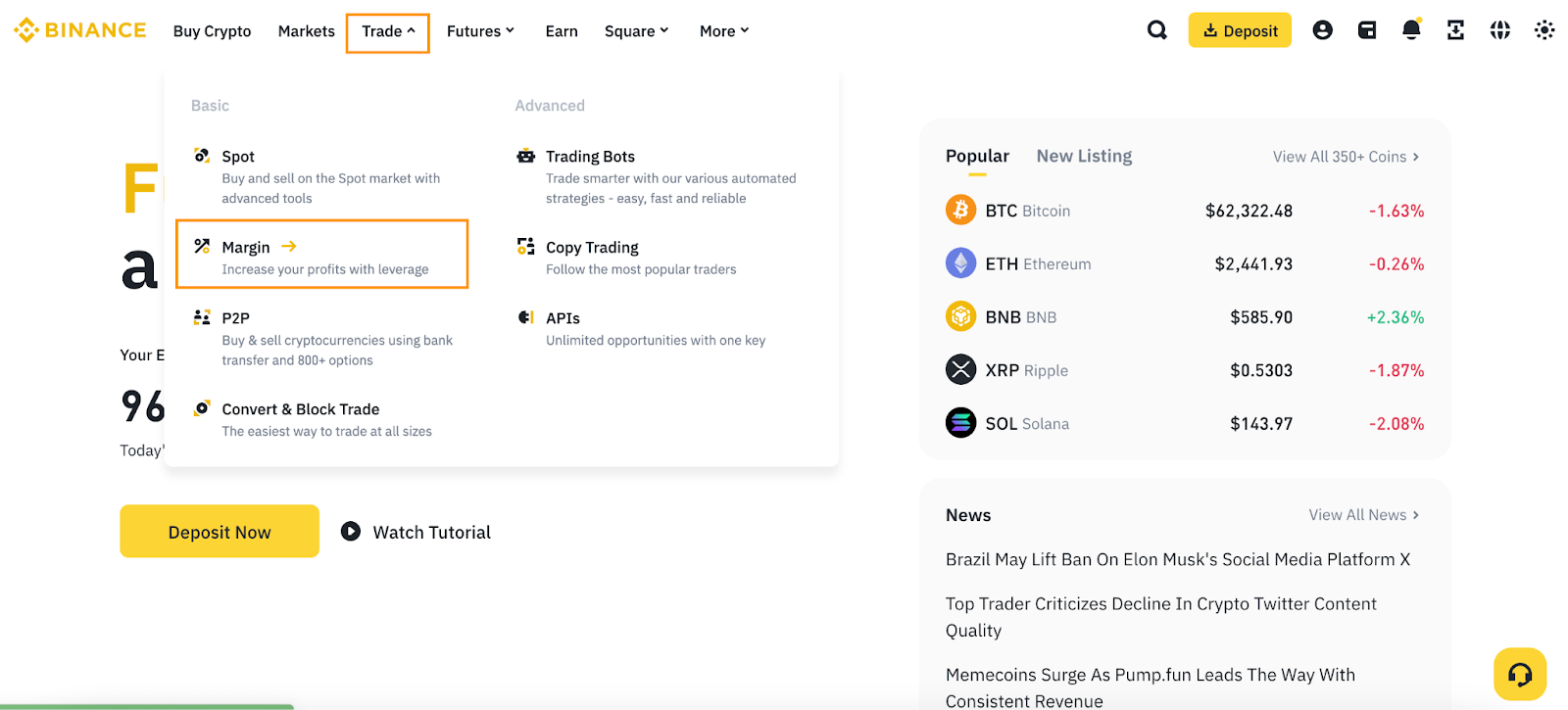

1. Log in to your Binance account and go to [Trade] - [Margin].

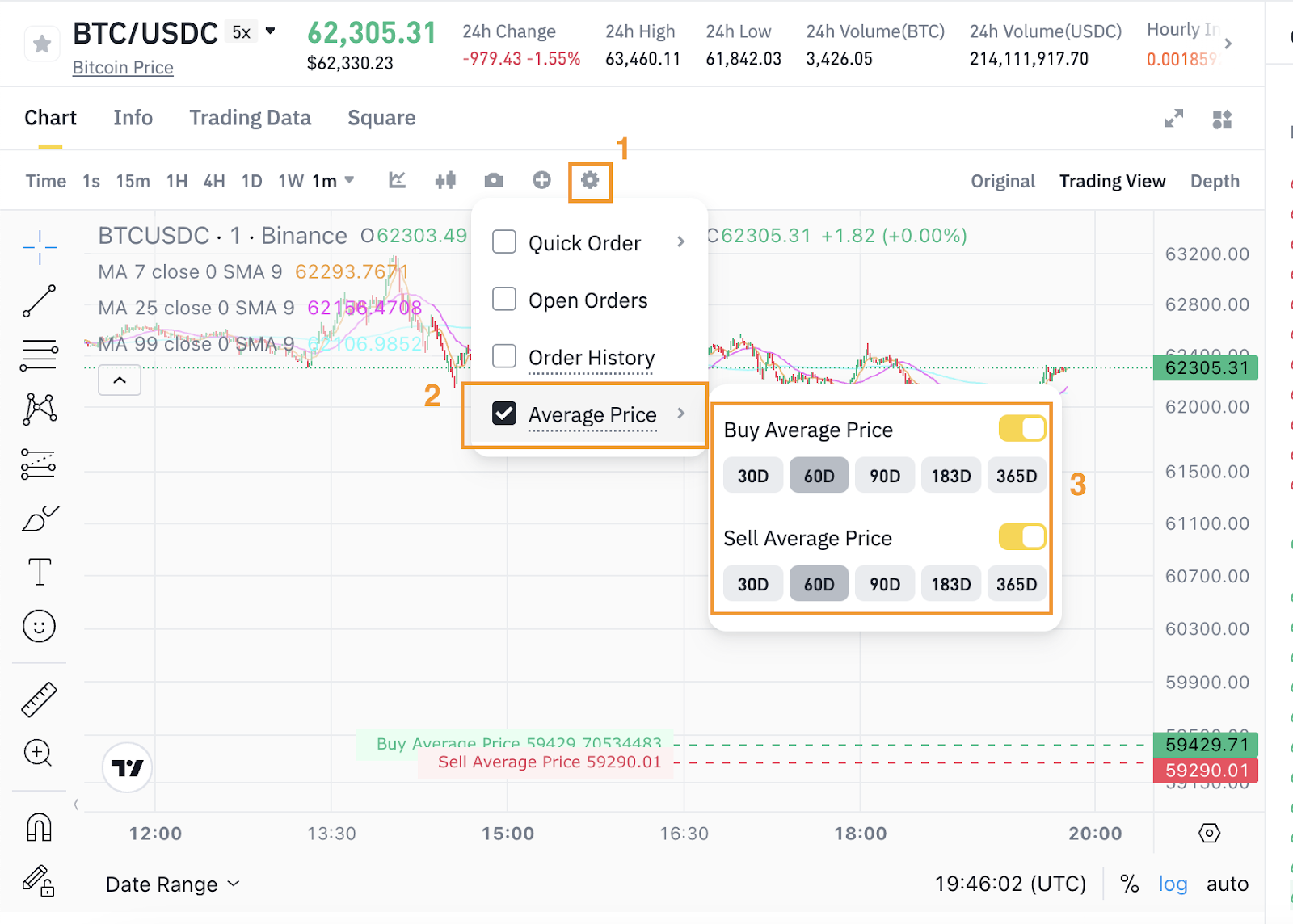

2. On the K-line chart, click [Settings], then select [Average Price]. In the pop-up window, you may choose your preferred time period for Buy/Sell Average Prices you want displayed.

Trade Analysis Tool

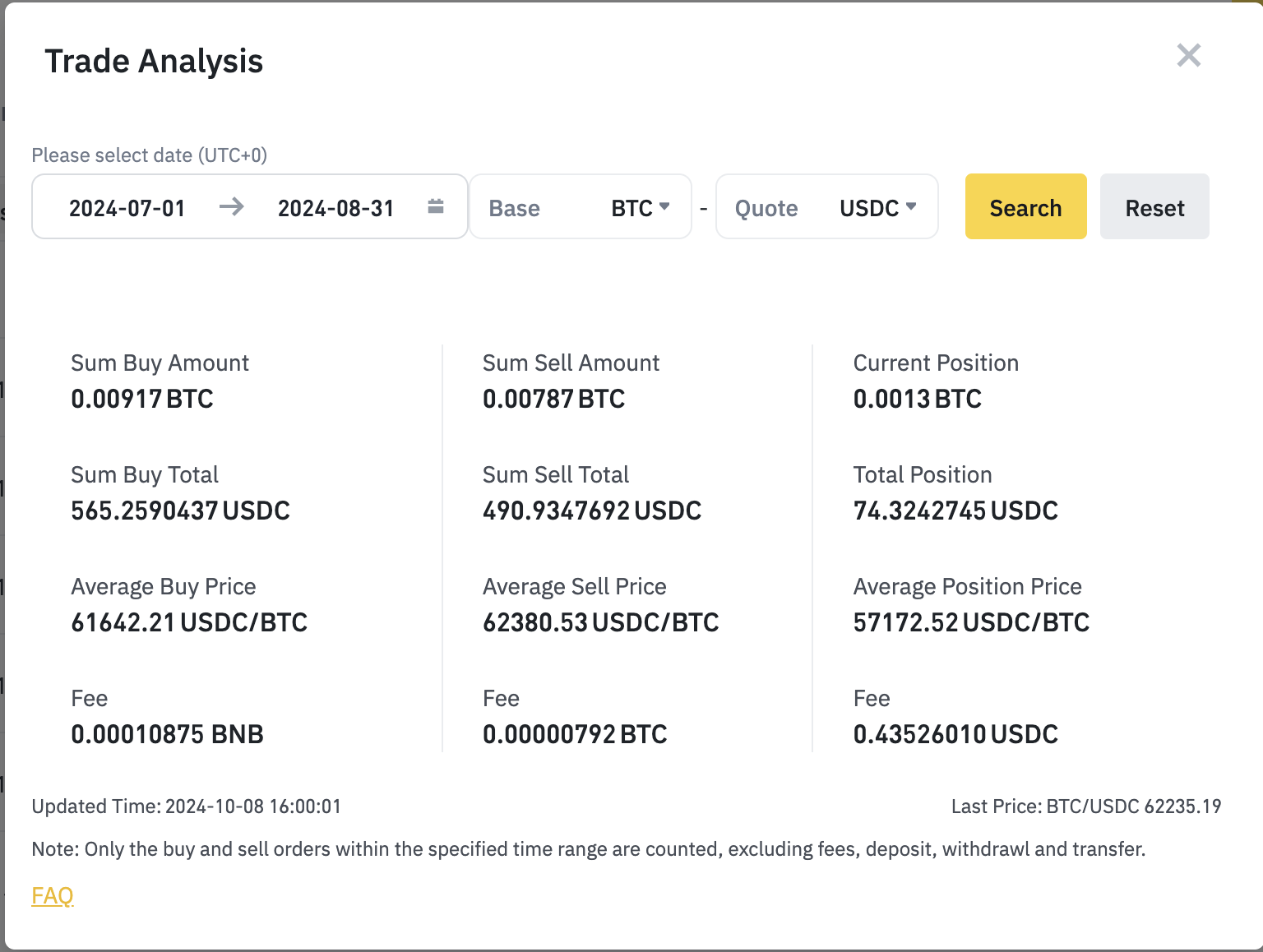

Trade Analysis provides comprehensive insights into your trading performance. This feature allows you to evaluate total buy/sell amounts, average buy/sell prices, and other essential metrics, helping you understand how well your trades are performing over specific periods.

To effectively manage your trading performance, understanding how to calculate your Current Position, Total Position, and Average Position Price is crucial.

Current Position

Current Position = Total Buy Amount - Total Sell Amount of the Base Token

Note: This data does not reflect the current balance of your Margin account.

Total Position

Total Position = Total Buy Amount - Total Sell Amount of the Quote Token

Average Position Price

Average Position Price = Total Position Cost / Position

For more details, please refer to How to View My Wallet PNL and Trade Analysis on Binance Margin?

How to use Trade Analysis?

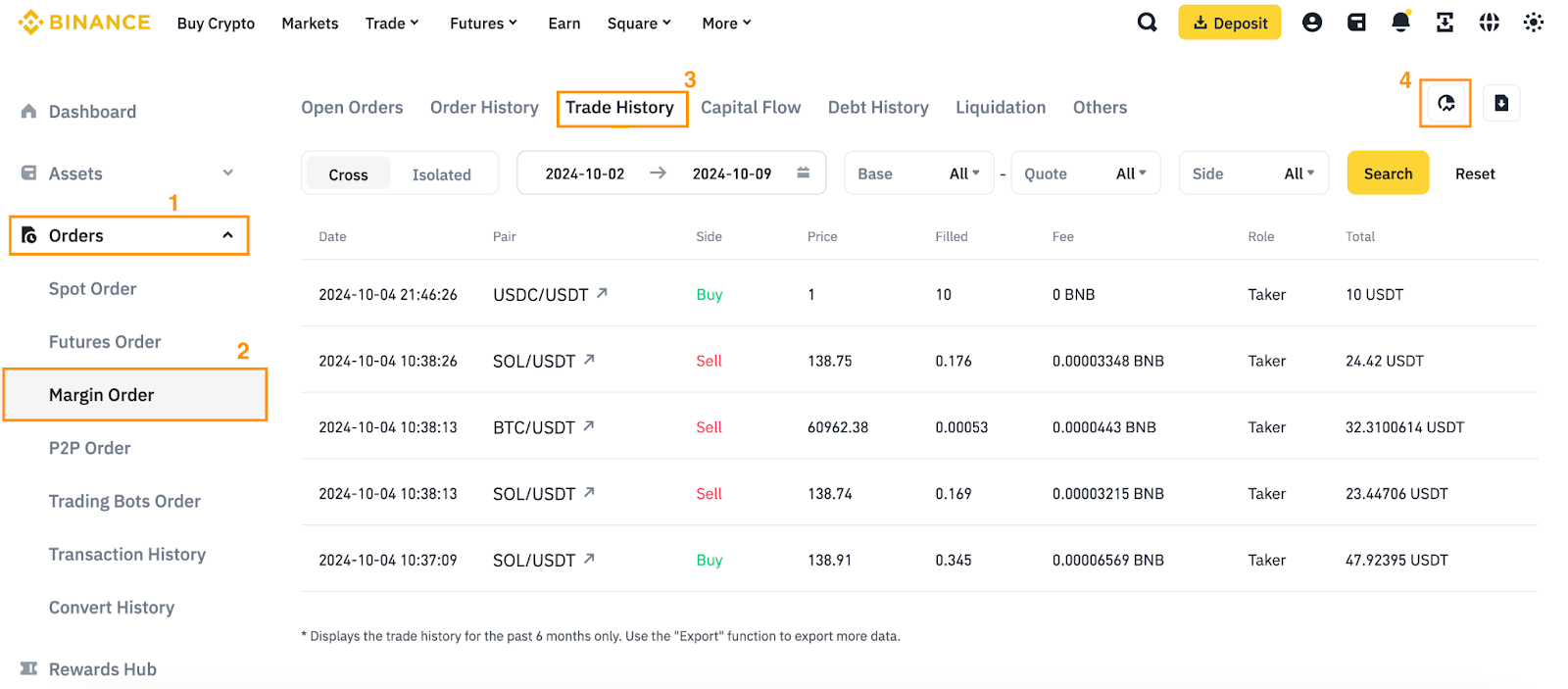

Go to [Orders] - [Margin Order] and select the [Trade History] tab. Click on the [Trade Analysis] icon at the top right corner to access your analysis tab.

Cross Margin Entry Price

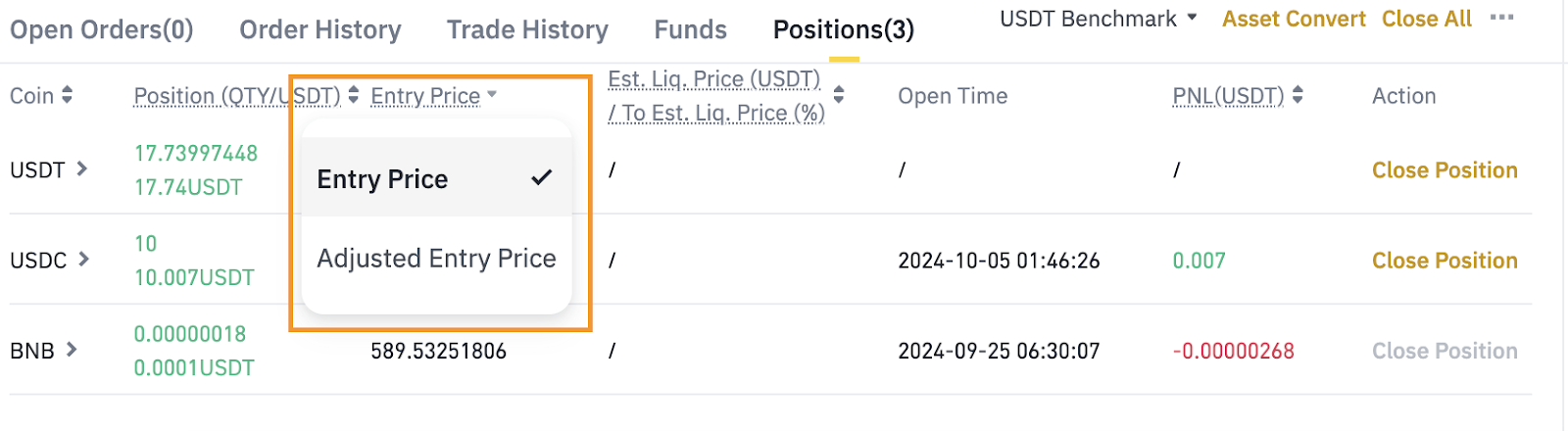

Cross Margin Entry Price is a key metric in a Cross Margin account, allowing you to trade the same base tokens with different quote tokens. In this scenario, Entry Price or Adjusted Entry price can be a valuable tool to strengthen your token analysis.

Entry Price is the weighted average price of assets in your Margin account, which include assets that were transferred in/out and assets that were purchased/sold.

For Long Positions, only transfer-ins and buy orders are counted.

For Short Positions, only transfer-outs and sell orders are counted.

Cross Margin Adjusted Entry Price

Cross Margin Adjusted Entry Price reflects the price of your position after taking into account the profit and loss from all trades. The main difference between Adjusted Entry Price and Entry Price is that Adjusted Entry Price accounts for all capital flows, including buys, sells, and transfers in and out. In contrast, Entry Price only considers one-directional flows based on long and short positions. Here is how it is calculated:

Adjusted Entry Price = (Total Buys + Transfer-Ins - Total Sells - Transfer-Outs) / Positions

Below is an illustration of how Entry Price and Adjusted Entry Price work. This example uses BNB as the base token, with the USDT benchmark. Interest and trading fees are excluded.

Note: In long positions, sell orders are not included in Entry Price calculations, but they are factored in for Adjusted Entry Price.

For more information regarding Entry Price and Adjusted Entry Price, please refer to Introduction to Margin Position Parameters.

Final Thoughts

Mastering the key parameters and tools available on Binance Margin, such as Average Price, Trade Analysis, Entry Price, and Adjusted Entry Price, is essential for any trader looking to optimize their performance. By leveraging these tools, traders can gain a clearer understanding of their trading activities, make more informed decisions, and ultimately improve their margin trading outcomes. Whether you are tracking your average buy/sell prices or analyzing your overall trade performance, these features provide the insights needed to navigate the complexities of margin trading effectively.

Disclaimer and Risk Warning: This content is presented to you on an “as is” basis for general information and educational purposes only, without representation or warranty of any kind. Digital assets are subject to high market risk and price volatility. The information provided does not constitute, in any way, a solicitation or recommendation or inducement to buy or sell the products. The value of your investment may go down or up, and you may not get back the amount invested. Comments and analysis do not constitute a commitment or guarantee on the part of Binance. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. This material should not be construed as financial advice. This product may not be available in certain countries and to certain users. This content is not intended for users/countries to which prohibitions/restrictions apply. For more information, see our Terms of Use and Risk Warning. To learn more about how to protect yourself, visit our Responsible Trading page.